Last-in, first-out LIFO method in a periodic inventory system

Bookkeeping

For example, in 2018, a number of sugar companies changed to LIFO as sugar prices rose at a rapid pace. After this, the price of the next most recent lot is charged to the job, department, or process. Let’s say on January 1st of the new year, Lee wants to calculate the cost of goods sold in the previous year. Imagine you were actually working for this company and you had to record the journal entry for the sale on January 7th.

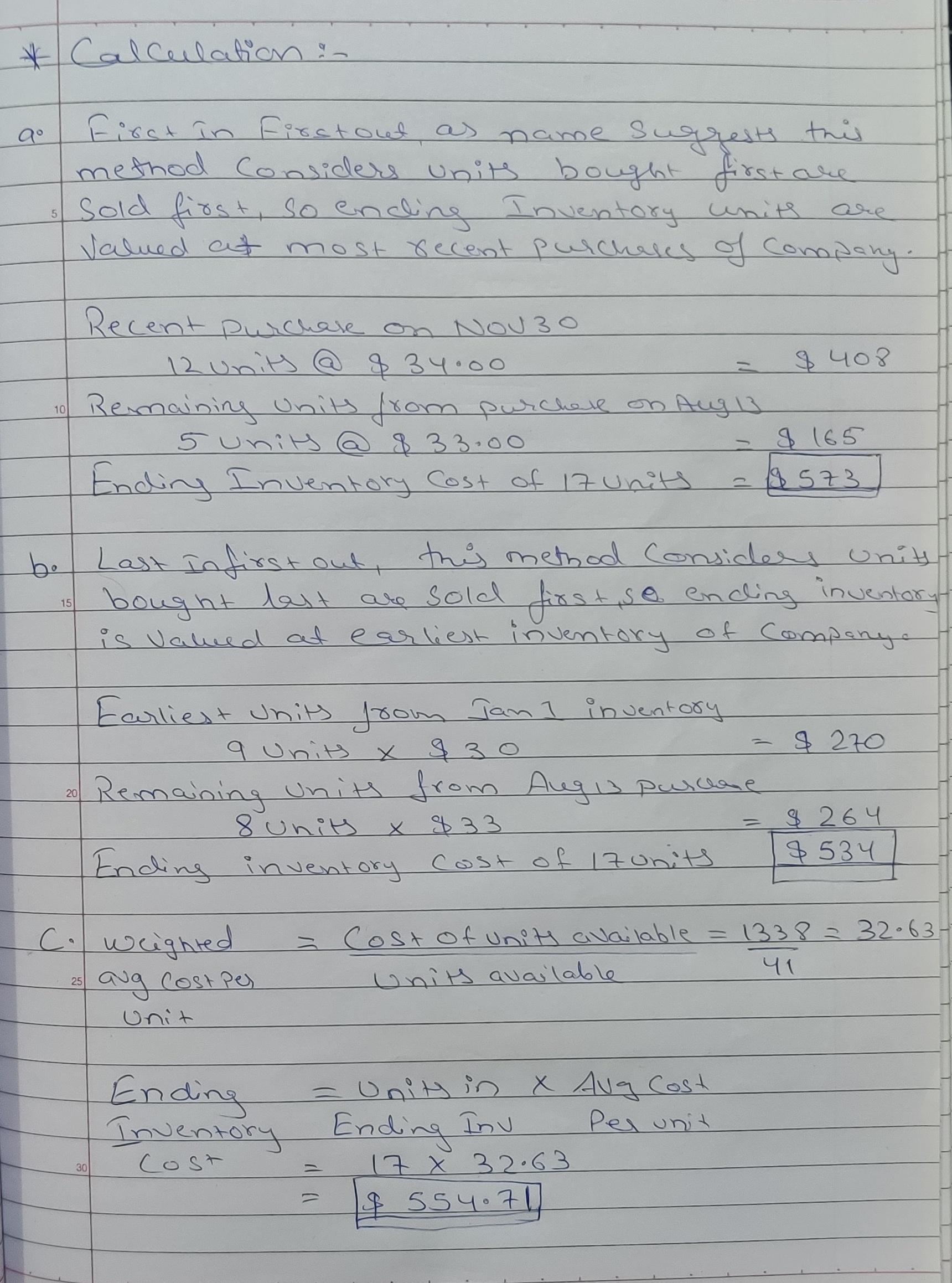

Last-In, First-Out (LIFO) Inventory Calculations

One pair cost $5 and was purchased in January, and the second pair was purchased in February and cost $6 unit. In LIFO periodic system, the 120 units in ending inventory would be valued using earliest costs. LIFO is extensively used in periodic as well as perpetual inventory system. In this article, the use of LIFO method in periodic inventory system is explained with the help of examples. To understand the use of LIFO in a perpetual inventory system, read “last-in, first-out (LIFO) method in a perpetual inventory system” article. LIFO is only allowed in the USA, whereas, in the world, companies use FIFO.

What is your current financial priority?

The periodic system is a quicker alternative to finding the LIFO value of ending inventory. Out of the 18 units available at the end of the previous day (January 5), the most recent inventory batch is the five units for $700 each. Second, we need to record the quantity and cost of inventory that is sold using the LIFO basis. She launched her website in January this year, and charges a selling price of $900 per unit. If you’re new to accountancy, calculating the value of ending inventory using the LIFO method can be confusing because it often contradicts the order in which inventory is usually issued.

Get in Touch With a Financial Advisor

Since we are using LIFO, we must take the last units in, which would be the units from January 12th. Then we would take the remaining 15 units needed from beginning inventory. Though both are legal to use in the United States, LIFO is considered to be more complex and is less favored. Ideally, LIFO is used when a business’s COGS tend to be higher and profits are lower. To calculate COGS, it would take into account the newest purchase prices.

Meanwhile, the cost of the older items not yet sold will be reported as unsold inventory. Last-In, First-Out (LIFO) is a widely used inventory management technique in various industries due to its relevance in specific situations. In general, the LIFO method assumes that the latest items added to the inventory are the first ones to be sold or used. This method is beneficial for industries with non-perishable goods or products with short life cycles or high obsolescence rates.

- In other words, it assumes that the merchandise sold to customers or materials issued to factory has come from the most recent purchases.

- It assumes that the newest goods are sold first, which normally increases the cost of goods sold and results in a lower taxable income for the business.

- Here are answers to the most common questions about the LIFO inventory method.

- In a standard inflationary economy, the price of materials and labor used to produce a product steadily increases.

As LIFO assumes that the most recently acquired items are sold first, a higher COGS may be reported due to the higher cost of recently acquired items. Conversely, ending inventory is valued at older costs, which might be lower than the current market values, resulting in potentially undervalued inventory on the balance sheet. Last In, First Out (LIFO) is an inventory valuation method that assumes the most recently added or produced items in a company’s inventory are the first to be sold. While LIFO is accepted under the Generally Accepted Accounting Principles (GAAP), it is not a permissible method under the International Financial Reporting Standards (IFRS). IFRS is a set of accounting standards developed by the International Accounting Standards Board (IASB), aiming to create a global framework for transparent and comparable financial reporting. Some benefits of using the LIFO method include better matching of costs to revenues, especially in times of rising prices or when the value of inventory items changes frequently.

The cost of inventory can have a significant impact on your profitability, which is why it’s important to understand how much you spend on it. With an inventory accounting method, such as last-in, first-out (LIFO), you can do just that. Below, we’ll dive deeper into LIFO method to help you decide if it makes sense for your small business. It’s good as it results in a lower recorded taxable income, giving businesses a lower tax bill.

It is worth remembering that under LIFO, the latest purchases will be included in the cost of goods sold. The result of this decline was an increase in earnings and tax payments over what they would have been basics of estimated taxes for individuals on a FIFO basis. By switching to LIFO, they reduced their taxable income and their tax payments. This is because the latest and, in this case, the lowest prices are allocated to the cost of goods sold.

The valuation method that a company uses can vary across different industries. Below are some of the differences between LIFO and FIFO when considering the valuation of inventory and its impact on COGS and profits. Make sure to only consider the units on hand at the time of the sale and work backwards accordingly.

In the last 10 years, she has worked with clients all over the country and now sees her diagnosis as an opportunity that opened doors to a fulfilling life. Kristin is also the creator of Accounting In Focus, a website for students taking accounting courses. Since 2014, she has helped over one million students succeed in their accounting classes. LIFO is legal in the US, but since it is banned by the IFRS, a globally accepted accounting standard, global businesses or businesses that operate outside the US cannot legally use LIFO. Here are answers to the most common questions about the LIFO inventory method.

hello